The Pluxee Cashback Card... the financial benefit for your employees' household

5 January 2023

Your employees' wages have never had to work harder. The cost of doing business remains high, and your employee financial wellbeing initiatives must be cost-effective and yield a return on investment whilst making maximum impact on your employees. Our Pluxee Cashback Card is powered by Visa prepaid. A digital solution, our Pluxee Cars is a virtual prepaid card and an employee benefit that supports your employees’ households. Read on to discover more about our Pluxee Card - the employee benefit your people and business need.

93% of adults have reported an increased cost of living compared with last year (ONS).

The monthly pay packet has never had to work so hard, with 7.8 million Brits struggling to keep up with the cost of their rising bills (FCA).

The cost-of-living crisis is hitting the UK hard, impacting employees' financial, physical, and mental wellbeing. Some situations are more severe than others, and whereas many households are only cutting back on non-essentials, others are struggling to find the funds to pay for essential items and put food on the table.

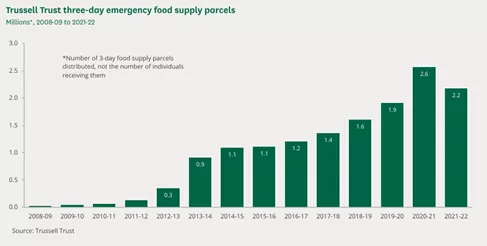

This House of Commons Library graph shows the number of emergency food parcels the Trussell Trust has provided since 2008. It may look like things have improved, but the 2020–21 figure reflects the impact of the Coronavirus and a spike in the reliance on food banks. Illness and lockdown substantially impacted people’s household income, increasing the use of food banks. When the UK ‘went back to business’, dependence on food banks reduced by 15.35%.

Whilst the pandemic has impacted the current financial crisis, what matters from this graph is the comparison between 2019-20 and 2021-22 when the lockdown didn’t escalate figures. There’s still a substantial rise of 16% - which follows the pattern between 2019-19 and 2019-20.

When we look back to 2012-13 – almost ten years ago – there has been a 633.33% increase in demand.

With experts predicting that the cost of living will increase again in 2023, the number of families struggling to afford essential food and household items will only climb.

We’re not just talking about a graph. This is a reality for many people across the UK.

Using education to reduce financial anxiety

Financial anxiety is a growing concern, causing additional workplace and personal stress. Prolonged and unmanageable stress can lead to ill mental health, exacerbating the initial financial difficulties. Without support or even intervention, the situation can quickly spiral.

Create a safe space and a supportive environment.

It’s crucial for your people to feel like they can turn to their manager or HR team for support and advice. To be open and honest about their financial situation and their difficulties.

It’s time to remove the stigma around talking about personal financial situations, and this starts within the workplace.

Tips for creating a culture of openness…

-

Provide financial education and create workshops with Financial Health First Aiders to give your employees the tools and knowledge to manage their money better.

-

Embed an Employee Assistance Programme into your business. As well as including financial wellbeing features, it will provide your people with access to BACP-accredited counsellors 24/7, ensuring there’s support available whenever they need professional and confidential help.

These are essential steps, but they only tackle part of the problem.

Financial wellbeing benefits stretch employees’ salaries and ease the financial burden, but they must be selected and implemented based on what your employees would make most use of.

It starts with education.

For your employee wellbeing strategy to have maximum impact, it must support your employees’ minds and money. This is where our Employee Assistance Programme comes into its own.

Boost employee resilience by empowering your people to make good decisions and giving them somewhere to turn whenever anxiety and stress become too much to handle alone.

Stretch salaries further with our Pluxee Card

Just like their employees, businesses must also make budgets stretch further.

Towards the end of 2022, many businesses announced pay rises to support their employees during the cost-of-living crisis. Salary increases only go so far, aren’t sustainable in the long term, and aren't viable for every company.

Employee benefits must be cost-effective and sustainable, and one of the best ways to make them successful is to put the power to save in your people’s hands.

Letting our Visa prepaid cashback card take centre stage!

We’re proud to say that our Pluxee Card is a market leader in the prepaid card industry. We have over 80 retailers participating in our cashback scheme, allowing your employees to earn up to 15% cashback whenever they use their Pluxee Card with them.

When your workforce embeds their physical or virtual prepaid card into their daily lives, they can earn significant cashback, making life more affordable. As a Visa prepaid card, your employees can use it anywhere, but they'll feel the most significant benefit when they earn cashback with one of our participating retailers.

Supporting your employees’ entire household

What is cashback, and how can it benefit your employees’ households?

Often used to tempt consumers into buying high-end goods, many retailers offer a percentage or fixed cashback amount when you spend with them.

Our Visa prepaid card works on the same principle. You use your Pluxee Card to purchase goods with one of our participating retailers, and they give you a percentage of your total spend in cashback.

One big difference with our Visa prepaid card is that the cashback isn’t there to tempt your employees to purchase an expensive product. No, no, no… the cashback is available on their everyday essentials.

It’s not about spending more. It’s about spending better and stretching salaries as far as possible.

Say an employee shops at a supermarket offering 4% cashback (as an example) via our cashback scheme. If they use our Visa prepaid card to pay for their weekly shopping instead of their regular debit card, they’ll earn cashback.

Spend £130 = £5.20 cashback x 52 weeks of the year = £270.40 in cashback earnings!

This is just one area of essential and regular spending. Your employees can also earn cashback when you use their Visa prepaid card – Pluxee Card – at popular gardening centres, DIY stores, clothes shops, days out, and so much more!

With a partner card available, the whole family can get involved with earning cashback while they spend. All it takes is a behaviour change.

How much cashback could you earn just by giving a little more thought to where you shop and which mode of payment you use?

Virtual and instant!

Start earning cashback instantly!

We deliver your employees’ virtual prepaid card account details as soon as they register. All they need to do is add them to their digital wallet of choice and load some funds, and they can purchase goods wherever a Visa prepaid card is accepted.

All your employees need to do is keep it topped up!

A versatile solution, you can add funds to the Pluxee Card as an employee benefit or use it to issue cash rewards and bonuses – stretching your support further with the cashback-earning potential.

Make your employees' wages work as hard as they do

When your employees are in a good place financially, physically, and mentally, they’re more engaged with their work. By supporting them and their household, you’re helping to alleviate their stress and anxieties. It’s a small price to pay when helping them will also benefit your business.

Pluxee UK has been supporting employers for over 60 years, and we continue to make it our mission to help you help your people succeed. Contact an employee wellbeing expert today for more information.

Sources: